|

| Rating: 4.4 |

Downloads: 500,000+ |

| Category: Finance |

Offer by: AppSupport |

Rapid! Pay App is a revolutionary mobile application that aims to transform the way we handle financial transactions. It offers a convenient and secure platform for users to send and receive money, make payments, and manage their finances with ease. With its user-friendly interface and cutting-edge features, Rapid! Pay App is quickly becoming a popular choice among individuals and businesses alike.

The app leverages advanced technology to ensure fast and reliable transactions, providing users with a seamless experience. Whether you need to split a bill with friends, pay for goods and services, or transfer funds to family members, Rapid! Pay App simplifies the process and eliminates the need for cash or physical cards.

Features & Benefits

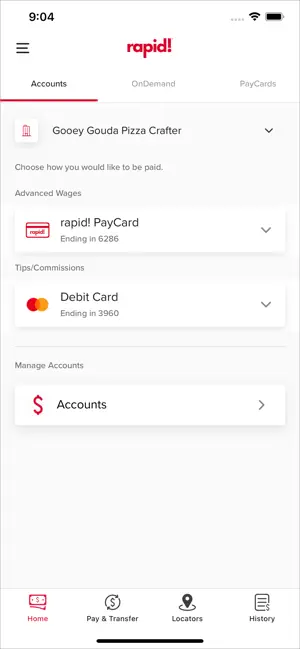

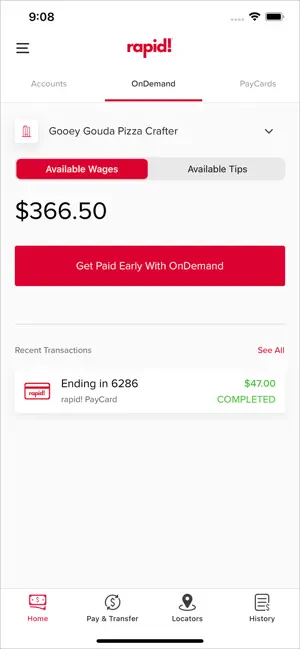

- Instant Money Transfers: With Rapid! Pay App, you can send money to anyone, anywhere in the world, in just a few taps. The app utilizes secure and efficient payment channels, ensuring that your funds reach the intended recipient instantly. Say goodbye to lengthy bank transfers and waiting periods.

- Contactless Payments: Rapid! Pay App supports contactless payments, allowing you to make purchases at participating merchants using your smartphone. Simply scan the QR code or NFC tag, and the payment is done. It’s a convenient and hygienic alternative to carrying cash or credit cards.

- Personal Finance Management: The app provides robust tools for managing your personal finances. You can track your expenses, set budgets, and receive real-time notifications about your spending habits. Rapid! Pay App helps you stay in control of your money and make informed financial decisions.

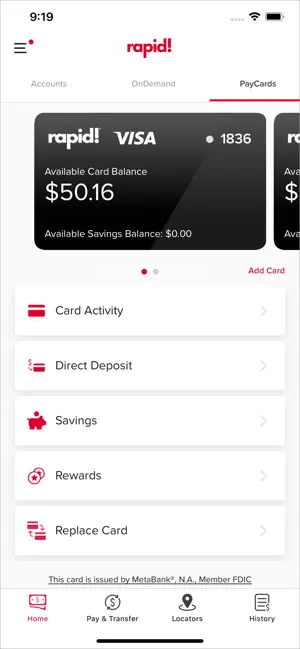

- Rewards and Offers: Rapid! Pay App offers a range of rewards and exclusive offers to its users. By using the app for your transactions, you can earn cashback, discounts, and other incentives. It’s a great way to save money and maximize the value of your purchases.

- Security and Privacy: Rapid! Pay App prioritizes the security and privacy of its users. The app incorporates advanced encryption techniques and multi-factor authentication to safeguard your financial information. You can use the app with confidence, knowing that your transactions are protected.

Pros

- Fast and convenient money transfers: Rapid! Pay App allows users to send money quickly and conveniently to anyone, anywhere in the world. Whether you need to split a bill with friends or send funds to family members, the app ensures that your transactions are processed efficiently.

- Contactless payments for added convenience and safety: With Rapid! Pay App, users can make contactless payments at participating merchants. By simply scanning a QR code or tapping their device on an NFC tag, they can complete transactions without the need for physical cash or cards. This feature not only enhances convenience but also promotes hygienic and safe payment practices.

- Powerful personal finance management tools: The app goes beyond facilitating transactions. It also offers robust tools for managing personal finances. Users can track their expenses, set budgets, and receive real-time notifications about their spending habits. This feature empowers individuals to make informed financial decisions and maintain better control over their money.

- Rewards and offers provide additional value: Rapid! Pay App rewards users for their loyalty and usage. By using the app for transactions, users can earn cashback, discounts, and other incentives. These rewards add value to the user experience, allowing individuals to save money and maximize the benefits of their purchases.

- Robust security measures ensure the safety of transactions: Rapid! Pay App prioritizes the security and privacy of its users. It employs advanced encryption techniques and multi-factor authentication to safeguard financial information. Users can have peace of mind knowing that their transactions are protected.

Cons

- Limited merchant acceptance in some areas: While Rapid! Pay App strives to expand its network of supported merchants, there may still be limitations in certain regions or countries. This could restrict users’ ability to make payments at their preferred locations, necessitating the use of alternative payment methods.

- Dependency on internet connectivity for transactions: Like many mobile payment apps, Rapid! Pay App relies on a stable internet connection to facilitate transactions. In areas with poor connectivity or during network outages, users may experience delays or difficulties in completing transactions, which can be inconvenient.

- Potential transaction fees for certain types of transfers: While many transactions on Rapid! Pay App are free, there may be fees associated with specific types of transfers, such as international remittances or expedited payments. Users should be aware of these potential fees and factor them into their financial planning.

- Availability may be limited to specific regions or countries: Rapid! Pay App may not be available in all regions or countries. This can be a drawback for users who travel frequently or have international financial needs. It’s important for users to check the app’s availability in their desired locations before relying on it as their primary payment solution.

- Newer app with limited user base compared to established competitors: Rapid! Pay App, while gaining popularity, is still a newer player in the digital payment market. Compared to well-established competitors, it may have a smaller user base and limited recognition among merchants. This could potentially impact its acceptance and integration with various businesses.

Apps Like rapid! Pay

- PayPal: PayPal is a well-established digital payment platform that offers similar features to Rapid! Pay App. It enables users to send and receive money, make online payments, and manage their finances. PayPal boasts a large user base and widespread merchant acceptance.

- Venmo: Venmo is a popular peer-to-peer payment app that focuses on simplicity and social integration. It allows users to send money to friends and split bills effortlessly. Venmo also offers a social feed feature that lets users see their friends’ payment activities.

- Apple Pay: Apple Pay is a mobile payment and digital wallet service offered by Apple. It enables users to make secure payments using their Apple devices, including iPhones, iPads, and Apple Watches. Apple Pay is widely accepted at various merchants and offers a seamless and secure payment experience.

rapid! Pay App Download

|

|

|

Conclusion

In conclusion, Rapid! Pay App is a transformative mobile application that redefines the way we handle financial transactions. With its fast and convenient money transfers, contactless payment options, personal finance management tools, rewards, and robust security measures, the app offers a seamless and secure payment experience. While there may be limitations in terms of merchant acceptance and availability in certain regions, Rapid! Pay App is continuously evolving and expanding its services to cater to a broader user base. Overall, it presents a compelling choice for individuals and businesses seeking a convenient, secure, and innovative mobile payment solution.

In a world where digital payments are becoming increasingly prevalent, Rapid! Pay App stands out as a game-changer. By leveraging advanced technology, the app simplifies transactions, empowers users with personal finance management capabilities, and ensures the security of their financial information. With its user-friendly interface and commitment to user satisfaction, Rapid! Pay App paves the way for a future where financial transactions are effortless, efficient, and tailored to individual needs.